State closes predatory lending loophole that affected thousands of small businesses

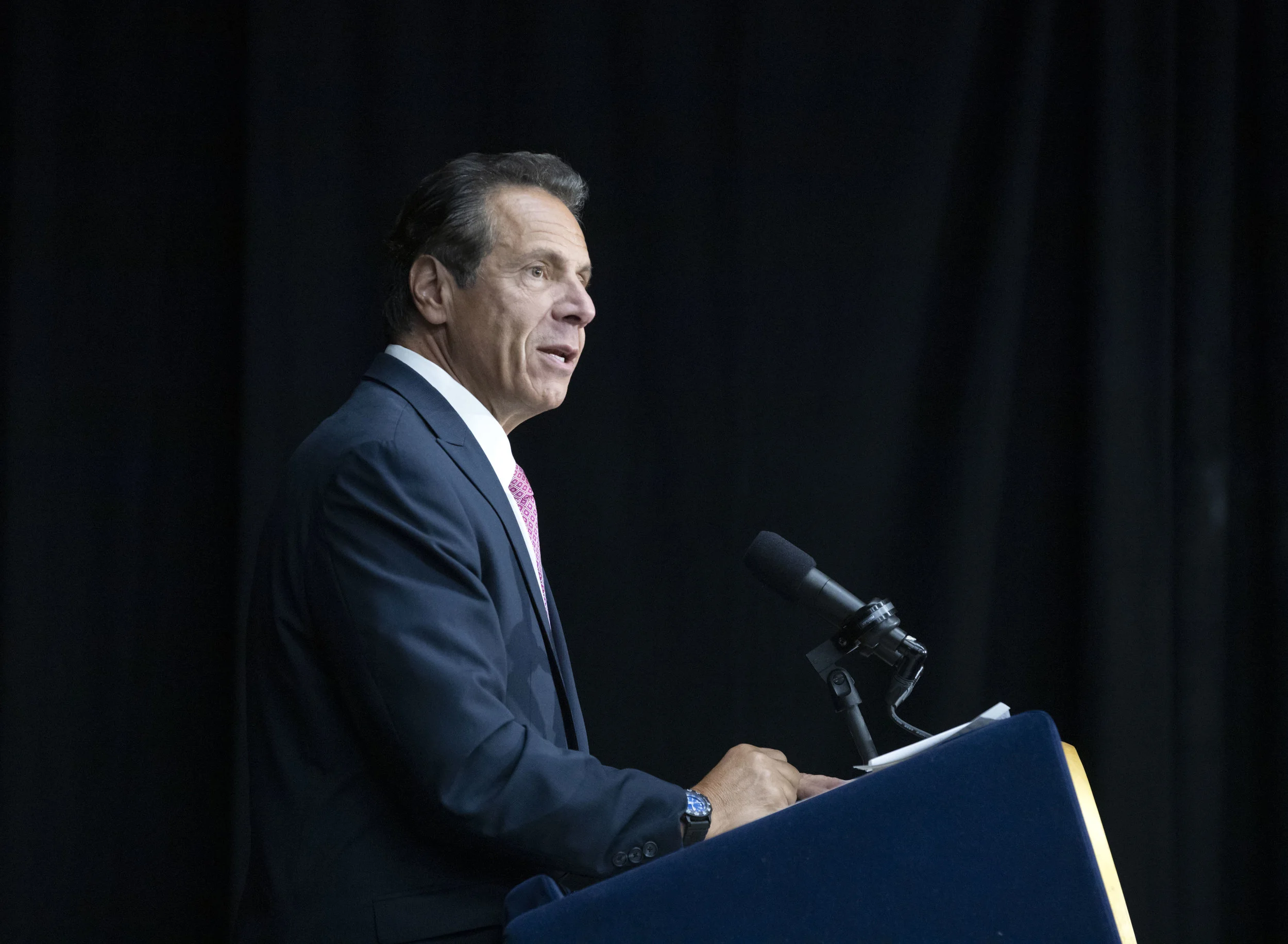

/Gov. Andrew Cuomo signed a law that would close a loophole that enabled predatory lenders to target thousands of small businesses. AP Photo.

By Victoria Merlino

Creditors won’t be able to use New York courts to seize borrower assets when they aren’t connected to New York, according to a new law signed by Gov. Andrew Cuomo on Friday.

“New York courts exist to uphold the rule of law, not to give unscrupulous creditors a means to prey on consumers,” Cuomo said in a statement. “By closing this loophole, we are strengthening our state's legal system and helping to ensure both in-state and out-of-state borrowers will not fall victim to these opportunistic schemes.”

Prior to the new law, creditors could seize a borrower’s assets in New York courts, even if the original agreement was not made in New York. This would subsequently difficult for the borrower to argue against the penalty.

Bloomberg News published a massive investigation into the predatory lending practices last year, finding that tens of thousands of small business owners had had their assets seized through the loophole, turning New York courts into what Bloomberg called a “high-speed debt-collection machine.”

Prior to the new law being passed, creditors could file confessions of judgement, documents that a borrower would sign that would relinquish their rights to defend themselves in court against the lender, according to Bloomberg. Though some states had outlawed the practice, New York was open to it.

Some creditors forged documents to falsely claim that borrowers were not paying back their loans, allowing them to seize their assets.