Queens small businesses demand COVID aid with rent due once again

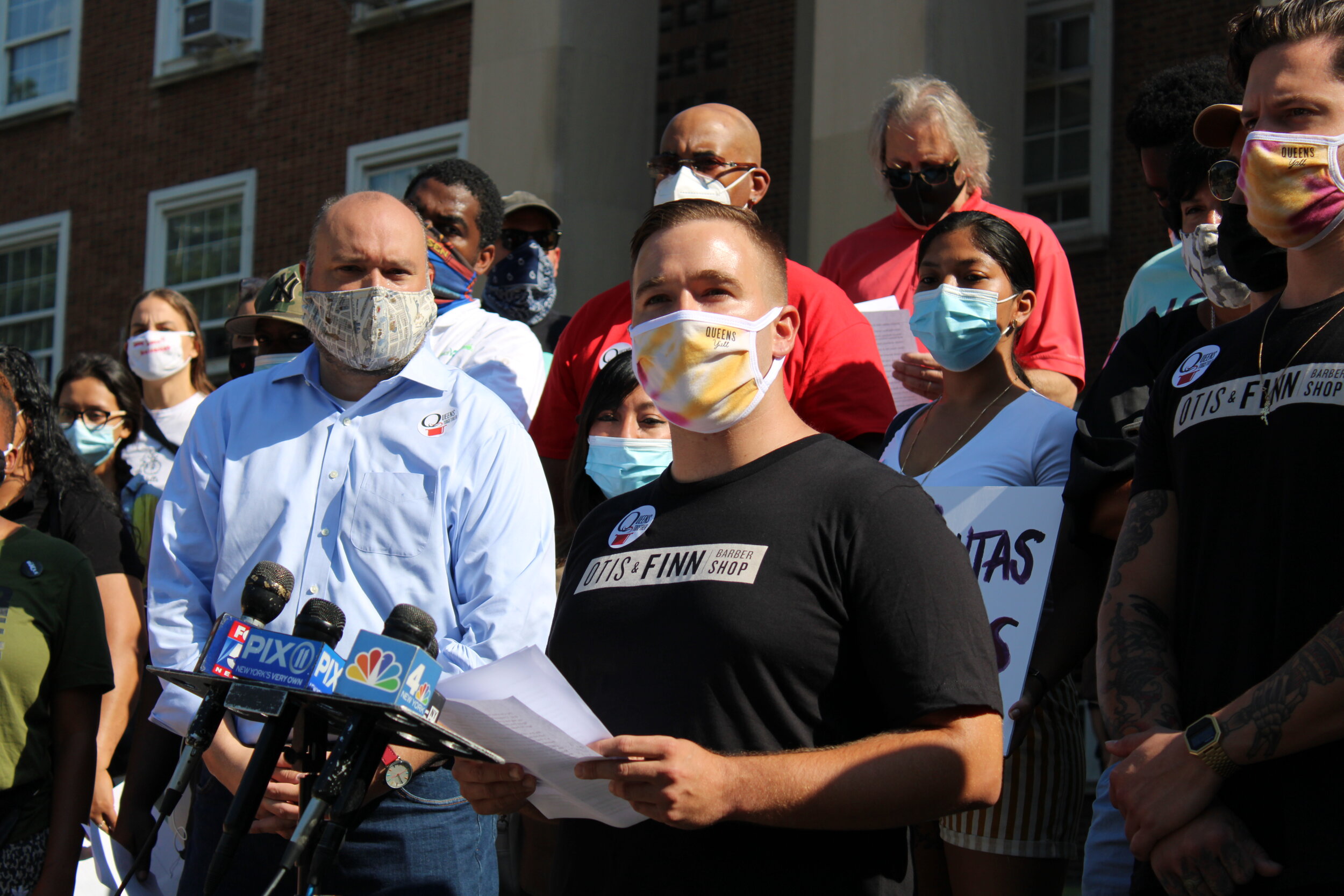

/Otis & Finn Barbershop owner Shawn Dixon said he and his partner spent $6,000 to comply with COVID-19 reopening restrictions. Eagle photos by David Brand

By David Brand

For 95 days, Shawn Dixon’s Long Island City barbershop Otis & Finn sat empty, generating zero revenue while saddled with monthly rent payments during the pandemic’s peak.

When the shop reopened, Dixon and his partner sunk another $6,000 into the business to pay for partitions and other COVID prevention supplies. Despite pledges from the city and state to support small businesses, Otis & Finn did not receive government assistance, Dixon said.

“Small businesses have been asked to carry the entire cost and responsibility of getting this city back on its feet on our backs alone, without any help from the government,” Dixon said during a Wednesday rally outside Queens Borough Hall. “It is unconscionable. It is immoral.”

More than a dozen other Queens mom-and-pop shop owners joined Dixon and Queens business leaders Wednesday to call for deeper investments from the city and state. With rent due in three days, they say they’re struggling to keep their firms afloat without the intervention.

They specifically called on the city to enact commercial rent control, fund more small business disaster loans and enable small companies to access city contracts to supply food to their communities. They also urged elected officials to continue advocating for more federal relief.

“We were already recovering from a fire that closed our business for half of 2019, so really we are a year into extremely tough times financially,” said Vic Champagne, the owner of 1976 Burgers & Wings in St Albans, who has provided free food for neighbors in need during the crisis.

“If businesses like mine close, I’m afraid they’ll be replaced by others that don’t have that same interest in caring for our neighbors,” he added. “That’s a huge loss for Queens.”

Vic Champagne, the owner of 1976 Burgers & Wings in St. Albans, speaks at a rally for small business relief outside Queens Borough Hall Wednesday. Eagle photo by David Brand

Jamie-Faye Bean, the co-founder of the small business group Queens Together, which organized the rally, said existing city relief programs have failed to reach companies in Queens, where rising commercial rents already threatened businesses boroughwide.

“We found that so many of our small businesses that are well positioned to meet the needs of our communities in crisis were not able to compete for those grants,” “At some point there is no lifeline left. We’ve run out of rope.”

“The businesses we take for granted and are always there for us aren’t going to be there anymore,” Bean said.

Councilmember Donovan Richards, the Democratic nominee for Queens Borough President, said city programs focus too much on Manhattan businesses. Roughly two-thirds of the city’s initial $20 million small business COVID loans went to companies in Manhattan.

“Queens, outside of Manhattan, is the largest contributor to New York City’s economy. So to slap our small businesses in the face by not giving them needed assistance is a disgrace,” said Richards, who has sponsored legislation to force Small Business Services to detail where their loans and grants go.

“There needs to be equitable distribution of these funds for each and every borough.”

Councilmember Donovan Richards, the Democratic nominee for Queens Borough President, said city relief programs focus too much on Manhattan businesses.

Mayor Bill de Blasio and Gov. Andrew Cuomo have called on the federal government to increase funding for local governments to dispense as part of the next federal relief package.

SBS spokesperson Samantha Keitt said her agency has helped connect 4,200 small businesses with local and federal grants and city loans since March.

“We are dedicated to giving small businesses in all five boroughs the tools they need to thrive, especially after the past few difficult months,” Keitt said.” We’ll continue to work with them to get them the tools and services they need to thrive.”

SBS has also offered small business aid trainings in six languages other than English, fielded more than 27,000 calls on its reopening hotline and shared guidance with more than 330,000 businesses, according to the agency.

While businesses have gradually resumed operations as the city enters the progressive phases of the New York state reopening plan, many shops and eateries face mounting debts, compounded by capacity restrictions and COVID-prevention costs, like partitions, sanitizing and outdoor dining space.

The impact of the virus could be devastating for Queens’ quintessential food culture, said Queens Chamber of Commerce President Tom Grech.

He reiterated an April prediction that 50 percent of Queens’ 6,000 restaurants may shut down forever.

“Sadly it may be coming true,” he said.