Maloney introduces bill to curb unchecked overdraft fees

/By Rachel Vick

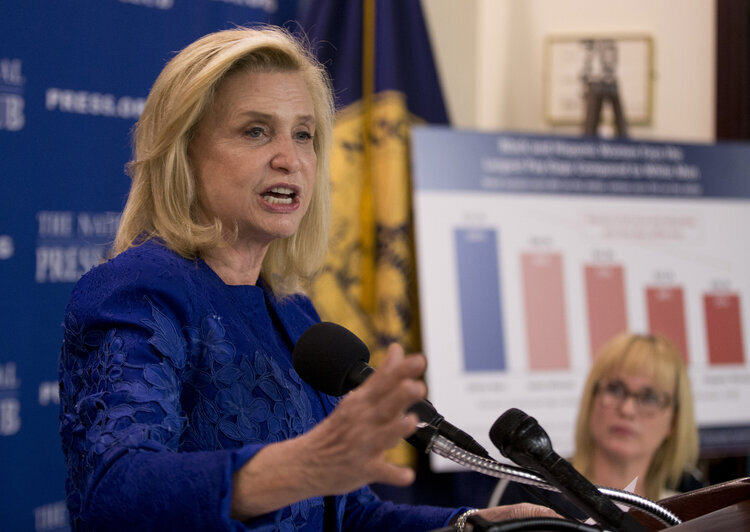

Queens Rep. Carolyn B. Maloney joined advocates in front of Wells Fargo on Madison on Friday to call on Congress to pass legislation to keep overdraft fee practices in check.

The Overdraft Protection Act of 2021, introduced by Maloney last week, would improve the transparency of overdraft programs for consumers.

“Overdraft fees are predatory and hit hardest those who can least afford them — cash-strapped hard working Americans and college students who are struggling to pay their bills, keep a roof over their heads, and food on the table,” Maloney said. “Making matters worse, even during the pandemic – when our country and the world was in the throes of both health and economic crises, banks charged billions of dollars in overdraft fees.”

In an open letter to J.P Morgan Chase last month, Maloney and other local legislators said that banks in New York received over $1.6 billion in fees state-wide since March of last year. They also found that New York City was among the two regions hit hardest by the fees.

Banks and financial institutions brought in an estimated $31 billion in consumer overdraft fees nationwide over the past year, according to DCWP Acting Commissioner Sandra Abeles.

“Lack of access to banks online and in-person coupled with not being able to afford a bank account because of fees like overdraft are hindering far too many New Yorkers—301,700 households—from getting banked,” Abeles said. “Profiting off vulnerable populations will only increase as government stimulus runs out and income volatility returns.”

Maloney has introduced a version of the act every session since 2009; the current version has 31 sponsors.

Carolyn B. Maloney introduced legislation last week to try and curb predatory overdraft practices. AP File Photo Manuel Balce Ceneta